The down payment assistance is provided in the form of a grant with a mandatory "affordability period" for the applicant to continue to occupy the house as their primary residence. Many counties qualify for a USDA rural mortgage, which does not require any down payment at all. This is one of the best loan programs in the country, as the minimum credit score is just 640, and you will not need to pay private mortgage insurance . The guarantee fee may be financed and the monthly amount goes to the Rural Development division of USDA, since this is a government backed loan program.

Down payment assistance can include loans, grants, tax credits1 and other programs designed to help eligible home buyers cover down payment or even closing costs. These programs are offered by federal, state, county or local government agencies, nonprofits or employers. Availability and qualification requirements vary by state. Bank, helps consumers with limited resources become homeowners, especially low-to-moderate income borrowers and in LMI neighborhoods. Some mortgage lenders offer their own down payment assistance. For example, Chase offers up to $3,000 that can go towards closing costs and down payment needs.

While this program isn't just for first-time homebuyers, it does have other stipulations. You'll need to get a 30-year fixed-rate home loan and you're required to make the home your primary residence. You'll also need to attend a homebuyer education course to receive the full amount. Rocky Mountain Mortgage Company is proud to provide down payment assistance programs to make the home buying process as easy as possible. These programs are designed to provide a set amount of money to qualified potential home buyers to help cover the expense of a down payment or closing costs. Rocky Mountain Mortgage Company is here to ensure that you receive the financial assistance you need for your future home.

Down payment assistance program funds are awarded to organizations throughout the state to create, continue and expand their existing down payment assistance programs. For many borrowers, particularly first-time buyers, the down payment and cash for closing costs is the greatest obstacle to buying a home. If you are having trouble coming up with the money for your down payment, you may have many options available.

There are many local programs that provide down payment grants, as well as down payment assistance loans to give you a forgivable, second loan that may even cover your closing costs. As part of the course, which you may be required to take to qualify for assistance, you'll learn about down payment assistance options. You can find homebuyer education programs by checking HUD's index of state and local housing programs.

Down payment assistance programs are available to home buyers nationwide, and many first-time home buyers are eligible. DPA can come in the form of a home buyer grant or a loan that covers your down payment and/or closing costs. Programs vary by state, so be sure to ask your mortgage lender which programs you may be eligible for. Eligibility criteria include an unspecified minimum credit score and caps on your household income and home purchase price.

You'll also need to put 1% of your own cash toward your home purchase. (The cost of your required homebuyer education course goes toward this 1%). It's possible to qualify for a mortgage from conventional lenders with a down payment as low as 3% of a home's final purchase price. If you're in the market to purchase a home and need help with a down payment and closing costs, the Ohio Housing Finance Agency can help. CHFA recognizes that saving enough money to pay the down payment is the main barrier to homeownership for many first-time homebuyers. If you can't get pre-approved for a mortgage, you probably can't take advantage of a down payment assistance program.

You're going to need a steady job, a good income and better-than-average credit score to qualify for a mortgage. But if the only thing holding you back from buying a home is the down payment, you may be able to overcome that with a down payment assistance loan. The DSHA's Preferred Plus Program offers a second mortgage loan of up to 5% of your home's purchase price.

You can put the money toward your down payment or closing costs. You'd need to repay the money when you sell the home, refinance, or stop using it as your primary residence. FHA, VA and conventional loans require the manufactured home be secured to a base.

If the manufactured home is not secured to a base, you will need to apply for what's called a chattel loan. Research your local down payment assistance programs and see what their specific requirements are. From there, contact your lender to see if they work with these programs. Rocket Mortgage® does not offer financing on manufactured homes. In addition to a low-down-payment mortgage, you may be eligible for a homebuyer's down payment assistance program offered by your state.

These programs are designed to make homeownership more affordable and accessible to borrowers. If eligible, you can receive help with your down payment and/or closing costs. Many lenders offer Fannie Mae and Freddie Mac's programs and add their own down payment assistance benefit for a conventional loan. For example, Guild Mortgage requires 1% down and provides a 2% gift for borrowers with qualifying low incomes and a minimum credit score of 680. Wells Fargo's yourFirst Mortgage® allows for 3% down with no area median income requirements.

A large number of grants and loans are available to help cover down payments and closing costs for first-time homebuyers across the country. Learn more about them as you take your first steps in the exciting journey to homeownership. Only certain homebuyers are eligible for down payment assistance. Eligibility varies by program, but requirements typically cover income, home price, creditworthiness, employment and an acceptable debt-to-income ratio.

These requirements are the same ones a mortgage lender will look for when deciding whether to extend a loan offer. Essentially, if you can get a mortgage pre-approval letter, but don't have a down payment, you can probably apply to one of these programs. Home purchase assistance programs frequently require the borrower to take first-time homebuyer education classes to qualify. Whether or not it's required by the program, Lindner recommends it anyway. These classes are an excellent way to educate yourself on the obligations of homeownership outside of just the mortgage and property taxes, he says. One is to get a zero-down USDA or VA mortgage if you qualify.

The other is to get a low-down-payment mortgage and cover your upfront cost using a down payment assistance program. FHA and conventional loans are available with just 3 or 3.5 percent down, and that entire amount could come from down payment assistance or a cash gift. Along with mortgage programs, statewide homebuyer assistance programs and tax credits, some individual mortgage lenders have their own down payment assistance program. To qualify, you will need to meet certain income limits and sale price limits, plus any credit minimums set by your lender. You'll also need to attend a first-time homebuyer education course and to pledge to live in the home as a primary residence.

MaineHousing's First Home Loan Program makes it easier and more affordable to buy a home of your own by providing low fixed interest rate mortgages. Not all down payment assistance programs are the same, as the money you received can be considered a grant, interest-free loan, or a debt that you pay off in the future. Almost all down payment assistance programs require you to live in your home as your primary residence for a certain amount of time. Down payment assistance programs provide a set amount of money to qualified home buyers, typically to cover down payment or closing costs. Generally, however, 3%-5% would be the absolute minimum, and only for certain borrowers.

Special programs in your state or local housing authority offer help to first-time buyers. Many of these programs are available based on buyers' income or financial need. These programs, which usually offer assistance in the form of down payment grants, can also help with closing costs.

The U.S. Department of Housing and Urban Development lists first-time homebuyer programs by state. Select your state then "Homeownership Assistance" to find the program nearest you. The requirements for each program vary, but are typically based on your income, the price of the home and your history as a homeowner. Assistance is available only for a home you plan to occupy and isn't available for vacation homes or investment properties. Many down payment assistance programs are for first-time home buyers, but don't count yourself out if you've previously owned a home.

If you have not owned a home in the last three years, you may be considered a first-time home buyer. But these organizations are administered at the state, county, and local level. Properties located just a few miles apart may qualify for completely different aid. And, the qualification guidelines for a buyer or property vary from program to program, Moss continues.

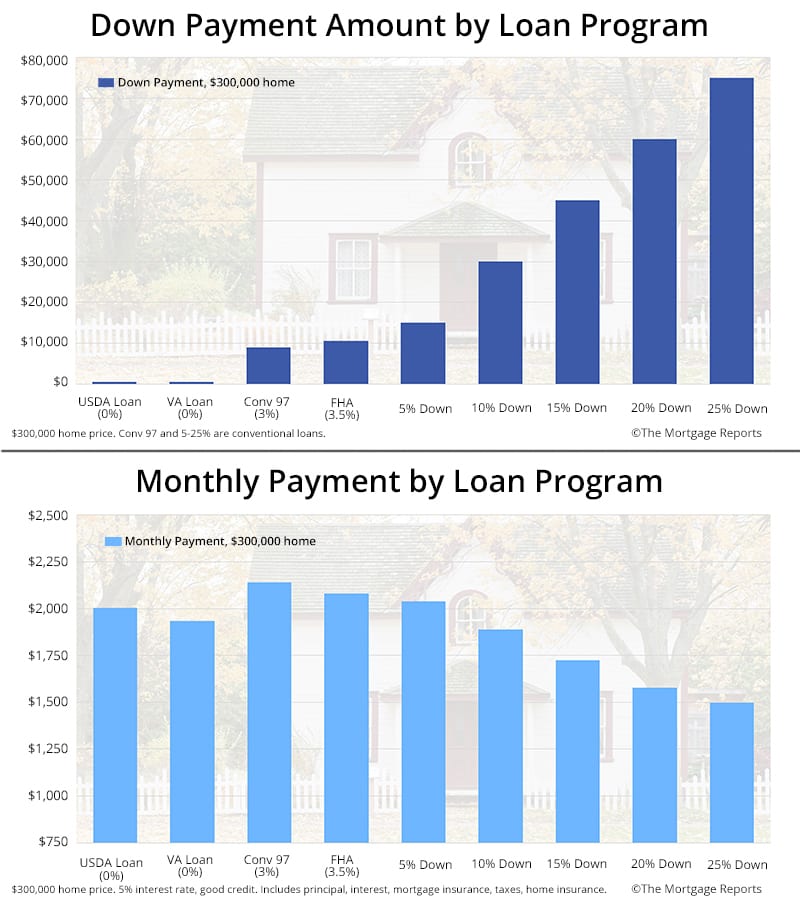

Taking advantage of a down payment assistance program can keep your savings accounts intact or increase your down payment. And many of these programs offer assistance with closing costs, which reduce your out-of-pocket expenses even further. Mortgage insurance is typically required with less than 20 percent down, but not always. For example, the VA Home Loan Guaranty program doesn't require mortgage insurance, so making a low down payment won't matter. Conversely, FHA and USDA loansalwaysrequire mortgage insurance. So even with large down payments, you'll have a monthly MI charge.

The only loan for which your down payment amount affects your mortgage insurance is the conventional mortgage. The smaller your down payment, the higher your monthly PMI. However, once your home has 20 percent equity, you'll be eligible to have your PMI removed. FHA loans typically require a credit score of 580 or higher and a 3.5 percent minimum down payment. You will also need a stable income and two-year employment history verified by W-2 statements and paystubs, or by federal tax returns if self-employed.

The home you're purchasing must be a primary residence with 1-4 units that passes an FHA home appraisal. Finally, you cannot have a recent bankruptcy, foreclosure, or short sale. There are lots of great reasons to consider a HomePath Home for your first home purchase, including low down payments and the HomeStyle renovation loan eligibility.

This means that if you purchase a HomePath home for $200,000, you will get a credit for up to $6,000 in closing costs. There are specific qualifications that entitle a person to use a home buying assistance program responsibly. One factor of the home buyer criteria includes income and financial requirements.

You must earn a specific income and have a specific credit score in order to qualify. In addition to basic financial determinants, there are specific professions that down payment programs can be applied to such as teachers, police officers, firefighters, veterans, and more. Our program is designed to educate, counsel, advocate, and assist home buyers with the home buying process. We do this by providing home buyer education that covers the benefits of homeownership, credit, lending practices, home inspections, and more. Our counselors assist with credit building, budgeting, and savings plans.

Our lending department is there to facilitate down payment and closing cost assistance and be an advocate for our clients throughout the home buying process. Eligible first-time homebuyers must meet certainincome and purchase price limits, have a credit score of at least 640, and complete a homebuyer education course. North Carolina offers a down payment assistance program known as the 1st Home Advantage Program. Their assistance comes in the form of a 0%-interest, deferred second mortgage that's forgiven after 15 years.

The home must serve as your primary residence and you must meet certain income limits. Down Payment Assistance allows homebuyers to choose either 2.5% or 5% of the home's purchase price. Assistance can be applied towards down payments, closing costs or other pre-closing expenses. If you sell or refinance your home within seven years, you must repay all of the assistance provided. If your assistance came in the form of a loan, you may have to pay it back in full when you sell the house or finish making payments on your home.

If you get the money in the form of a first time home owners grant you don't have to pay it back; the money is yours to cover the down payment or closing costs on your home. It's not impossible to buy a home if you don't have much cash saved up for a down payment. Shopping around for the right lender and loan type is a critical step.

With a lower down payment, expect to pay higher loan fees and interest rates, as well as PMI. Also, don't forget to tap into down payment assistance programs offered by your state or city. If someone offers a financial gift toward your down payment, make sure they understand it cannot be a loan. Tax credits - Certain states and local governments, including housing finance agencies , issue mortgage credit certificates, which reduce the amount of federal income tax you pay. This makes more money available upfront for your down payment or closing costs. The assistance funds come in the form of a zero-interest second mortgage with a 30-year term.

This second mortgage will be forgiven if the borrower makes 36 consecutive, on-time payments on the first mortgage. Home buyer grants are offered in every state, and all U.S. home buyers can apply. DPA programs are widely available but seldom used — many home buyers don't know they exist.

Eligibility requirements typically include having low income and a decent credit score. To qualify, you'll need a minimum credit score between 620 and 660, depending on the type of mortgage you choose. And your household income and the purchase price of your home must be belowspecified limits.

To qualify, you'll likely need a credit score of 640 or better. And your household income will be capped at amounts that vary according to family size and the county of purchase. There are also limits on the purchase price of the home you're buying, most commonly up to $453,100. Research what programs are available in your area, if any.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.